Banner courtesy of the Genesius Guild Theatre Foundation

Info for Donors

The only sources of funds for the Rock Island Community Foundation are gifts, bequests or grants from the citizens of the community and area businesses. No contribution is too small, and any such tax-free and tax-deductable gift will be received with genuine gratitude.

Anonymous gifts are gladly accepted. The Foundation is also able to comply with various other conditions and restrictions which donors may wish to impose on their gifts or bequests.

The Foundation operates solely in the public interest and has no alliances whatsoever with private interests. The foundation also does not conflict or compete with existing charitable organizations - its purpose is to supplement rather than challenge such organizations.

Click here to learn more about our gift acceptance policies

Below, we have outlined some of the most common ways citizens contribute to the Rock Island Community Foundation. Alongside these donation options, you will see some of the many organizations our funds have helped in the past. If you have questions or concerns about donation methods, please don't hesitate to reach out to us. We are happy to provide more information, tailored to your particular gift. Through your generosity, we are committed to helping Rock Island grow for years to come.

.FY’23 DONORS—September 1, 2023—August 31, 2024

$100,000

Stan & Kay Coin Charitable Trust

$50,000

Friendship Manor

$25,000

Harlan M. Wiss Charitable Remainder Trust

$1,000 +

Ann Austin

Norm & Janet Moline

Robert & Marilyn Noe

Michael & Sue Oberhaus

Gary & Linda Rowe

Mark & Debbie Schwiebert

$500-$999

Dorothy Beck & Phil Dennis

Karla Miley

$200-$499

Bryan & Michele Blew

Mike & Sara Darrow

Jerry Goddard

Thomas & Susan Hammar

Jack & Mary Knepp

Bill & Cathy Marsoun

Paul & Sue McDevitt

Jennifer Walker

$100-$199

Steve & Marla Andich

Dean & Julie Bacon

Ann Balderson

Robert Braun

Nancy Califf

James & Sally Cecil

Kurt Christoffel

Michael Diamond & Lori Lefstein

Lowell & Patricia Dorman

Lawrence & Cynthia Graves

Paul & Julie Hansen

Rose Ann & Jim Hass

Robert & Carol Hawes

Virginia Houlton

Sonja Knudsen

Kevin & Jane Koski

Liz & James Loveless

Chip & Vicky Morrow

Ted & Lori Pappas

John & Karen Phillips

Nancy Taber

Up to $99

Louis & Laura Belby

Emma Carillo-Peters

Alan Carmen

Jeff & Martha Dismer

Donald & Katherine Healy

Carolyn Krueger

Robert & Kathy Lelonek

Jeff & Mary Newcomb

Paul Plagenz

Margaret Tweet

IN KIND

Mandle Design

IN HONOR

Ann Austin

Julie & Paul Hanson

IN MEMORY

Kay Coin

Ann Austin

Stan & Kay Coin

Gary & Linda Rowe

River Bend Food Bank

Foundation Investments

When it was formed, the Rock Island Community Foundation executed a Trust Agreement appointing two banks to serve as Trustees of the Foundation's funds and of all subsequent gifts or testamentary bequests made to the Foundation. Thus, professional management, continuity of control and security of the funds are assured for this charitable organization.

Gifts of Cash

Individuals and Corporations

The simplest way to give is to write a check payable to the Rock Island Community Foundation and mail it to the Executive Director at 1800 3rd Avenue Suite 302, Rock Island, IL 61201. Or call 309-948-3403 to make other arrangements. Corporate or business gifts of this nature, are also respectfully solicited and welcome.

Of course, we will honor donors’ preferences if they wish to restrict their gifts to a specific organization or cause.

Ballet Quad Cities

Spring Forward

Memorial Gifts

If you desire to make a memorial gift, please include the name of the person being honored, and the names of the relatives to be notified by the Foundation. This is a wonderful way to honor the life of a loved one.

Girl Scouts of eastern iowa and western illinois

Gifts of Stock or Real Estate

Anything of value may be the subject of a gift - not only cash, but stocks, bonds, debentures, even real estate - can be donated to the Rock Island Community Foundation.

Big Brothers big sisters of the Mississippi valley

Gifts of Life Insurance

Life insurance policies can be made payable to the Rock Island Community Foundation.

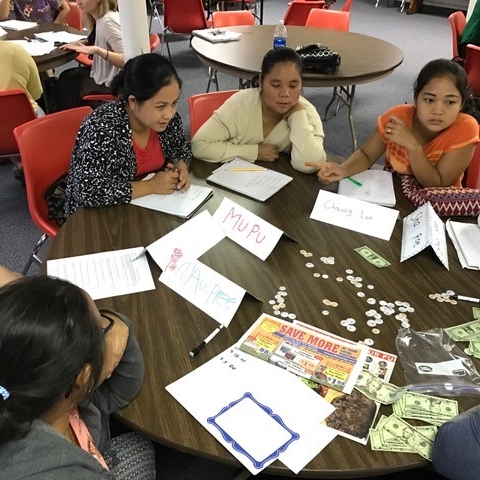

Youth hope camp summit

Leave a Legacy - Bequests

Another excellent way of helping the Rock Island Community Foundation, as well as your community, is to include a provision in your will for the payment of a specific sum to the Foundation (or name the Foundation as the residuary beneficiary of your estate). This type of gift would not be payable until after the donor's death.

Estate gifts are one of the simplest, most flexible, and most popular ways you can support the Rock Island Community Foundation.

HERE’S HOW YOU CAN DO IT:

Use the language in your life insurance, IRA, or other beneficiary designation forms OR

Provide it to your attorney for your will or living trust

YOUR CHARITABLE BEQUEST MIGHT BE:

A specific dollar amount

A percentage of the estate

Specific assets

SAMPLE LANGUAGE: I leave ($ amount/% of my estate, etc.) to the Rock Island Community Foundation, an Illinois corporation with Tax ID 36-6163829, to support the Foundation’s work in Rock Island, IL.

You also can contact a Gift Planning professional to prepare your gift and inform the Rock Island Community Foundation of your intentions.

Still have questions?

We are happy to help in any way we can. If you want more information about donating to the Rock Island Community Foundation, simply reach out in whichever way is most convenient for you.

Visit Us

1800 3rd Avenue, Suite 302

Rock Island, IL 61201

Call or Email

Executive Director, Gary Rowe

309-786-8551

gnrowe47@gmail.com